Settlement Expectations: How Long Does It Take to Settle a Rear-End Accident?

Rear-end accidents are among the most common vehicle collisions, yet their settlement timelines vary significantly based on injury severity, liability clarity, and insurance responsiveness. If you're waiting for compensation after a rear-end collision, understanding the typical settlement process can help you prepare for the financial journey ahead.

Many plaintiffs face months or years of uncertainty while managing medical bills, lost wages, and ongoing treatment costs—which is why

Best Call Funding provides pre-settlement funding to ease the financial burden while your case develops.

Settlement Timeline?

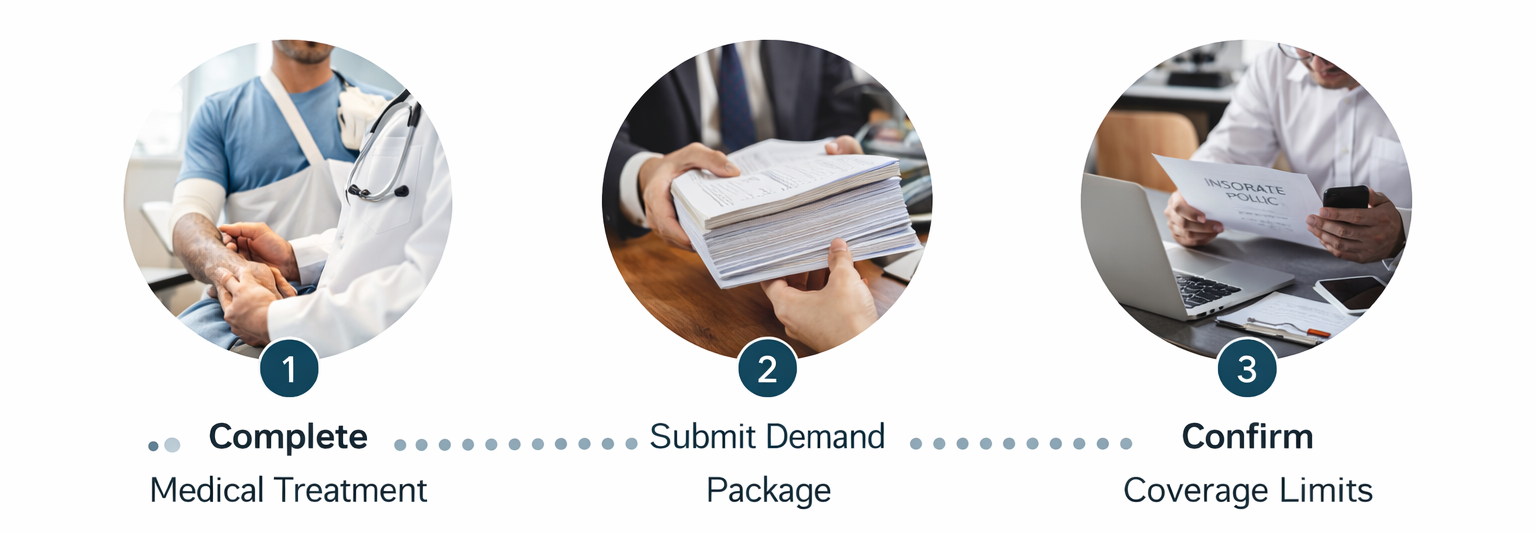

Most plaintiffs assume the settlement clock starts on the accident date. In reality, insurance companies don't begin serious valuation until three (3) specific milestones are met: (1) completion of initial medical treatment, (2) submission of a formal demand package, and (3) confirmation of liability coverage limits.

This distinction explains why two people injured on the same day can have radically different timelines depending on how quickly they are treated, when their attorney sends a demand, and how responsive the insurer is. Understanding which event actually controls settlement timing prevents unrealistic expectations and explains why waiting often feels longer than anticipated.

The Typical Rear-End Settlement Timeline

Most rear-end accident cases settle within six (6) to twelve (12) months after a claim is filed, though timelines can extend beyond this range. Simple cases with clear liability and minor injuries may resolve in three (3) to six (6) months, while cases involving serious injuries or disputed fault can take eighteen (18) months or longer. The initial phase includes gathering evidence, obtaining medical records, and establishing treatment costs, typically taking thirty (30) to sixty (60) days.

Once this phase is complete, your attorney sends a demand letter outlining your injuries, expenses, and compensation request. The insurer’s response and counter-offer begin formal negotiations, which often take another two (2) to four (4) months. Actual timelines vary significantly and depend largely on when your medical treatment reaches substantial completion.

Why Rear-End Cases Often Settle Faster

Rear-end accidents carry a significant advantage: presumed liability. The driver who rear-ends another vehicle is automatically presumed at fault in most jurisdictions, eliminating the need to prove negligence. This clarity accelerates settlement negotiations because the insurance company faces minimal liability defense arguments.

When you compare rear-end settlements to other injury claims, the advantage is clear. Rear-end accidents typically resolve within six (6) to twelve (12), while side-impact or fault-contested cases frequently exceed eighteen (18) to twenty-four (24) months due to reconstruction requirements, witness disputes, and liability litigation. However, not all rear-end cases are straightforward—if liability becomes disputed, the timeline can extend by several months.

Insurance Company Response Requirements

and Regulatory Deadlines

While settlement timelines vary, you can use official claim handling deadlines as benchmarks to gauge insurer responsiveness and compliance. In California, the Department of Insurance's Accident – What to Do guide—an official government publication—explains that insurers should contact claimants within a reasonable period after a loss is reported and begin processing the claim promptly. These timelines aren't just industry practice; they're backed by state regulation.

State-Mandated Insurance Deadlines (California Example)

California’s

Fair Claims Settlement Practices Regulations require insurers to acknowledge and investigate claims within fifteen (15) days, respond to communications within fifteen (15) days, accept or deny claims within 40 days of receiving complete proof, and issue payment within thirty (30) days after settlement. These deadlines are legally enforced. When insurers fail to comply without justification, attorneys can apply pressure and escalate violations to state insurance regulators.

Medical Treatment Timeline and Settlement Delays

Your settlement cannot finalize until your medical treatment is substantially complete. Insurance companies typically won't make final offers while you're still undergoing active therapy, receiving injections, or awaiting surgical procedures. This medical completion requirement is one of the primary reasons settlements extend beyond initial expectations.

Minor soft-tissue injuries like whiplash may resolve within six (6) to eight (8) weeks, while serious injuries can require twelve (12) to twenty-four (24) months or longer. Gaps in treatment, ER-only care without follow-up, or delayed symptom reporting often trigger insurer scrutiny, lower offers, and longer settlement timelines. Consistent treatment helps avoid delays and protects case value.

Why Faster Settlements Usually Mean Lower Compensation

Insurance companies often push for early settlement before your medical trajectory is fully documented. This is critical: early offers rely on incomplete records, conservative injury assumptions, and minimal future care projections. Waiting allows your attorney to document treatment progression, long-term limitations, and specialist opinions—all of which materially increase case value.

Many rear-end cases that settle in three (3) to four (4) months close for significantly less than cases that resolve after medical stability, even when injuries initially appear similar. Your attorney's role includes strategic timing to maximize recovery based on medical documentation. Rushing settlement to end the waiting period typically results in substantial financial losses far exceeding the waiting period itself.

Insurance Delays: Strategic vs. Accidental

Insurance delays often serve strategic goals: encouraging financial pressure on plaintiffs, waiting for claimant fatigue, or leveraging medical uncertainty to justify lower offers. Many insurers intentionally extend timelines knowing that financially desperate claimants often accept lower settlements to end the waiting period.

This is why settlement pressure should never drive your negotiation decisions. Your attorney's role includes resistance to artificial urgency and strategic patience. When insurers delay beyond regulatory requirements, your attorney can file litigation to apply pressure and demonstrate commitment to fair compensation.

Financial Pressure While Waiting for Settlement

While your case moves forward, your expenses continue. Medical bills, therapy costs, and lost wages create immediate financial strain, often forcing plaintiffs to choose between necessary treatment and high-interest debt. Insurers understand this pressure and may use delays to push claimants toward early, lower settlements.

Best Call Funding helps relieve this burden by providing pre-settlement funding based on your case’s expected recovery. With a non-recourse structure—meaning you only repay if you win—funding allows you to cover living expenses, continue treatment, and give your attorney the time needed to pursue full compensation without financial pressure influencing settlement decisions.

How Best Call Funding Supports Your Recovery Timeline

Whether your rear-end case settles in 6 months or extends to 18 months, Best Call Funding helps ensure you’re not financially overwhelmed while waiting. Funding is designed to support plaintiffs throughout the entire litigation period, regardless of how long settlement takes.

Fast, Attorney-Centered Application Process

The application process is simple. You apply online with basic case details, and Best Call Funding works directly with your attorney to gather the necessary information—so you only provide it once. Most applications receive approval decisions within 1 to 24 business hours.

Quick Access to Funds

Once approved, funding typically arrives within 24 to 48 hours. Wire transfers may deliver funds the same day, direct deposit usually arrives within one business day, and paper checks are available upon request. Most plaintiffs receive approximately 10% to 15% of their expected settlement value.

Non-Recourse, No Monthly Payments

Best Call Funding operates on a non-recourse basis. If your case doesn’t succeed or settles for less than expected, you owe nothing. There are no monthly payments during litigation—repayment occurs only after settlement and only from settlement proceeds.

Making Your Rear-End Case Decision: Best Call Funding as Your Financial Partner

Rear-end accident settlements often take 6 to 12 months, with timelines varying based on medical treatment, insurer responsiveness, and negotiation complexity. Best Call Funding helps relieve financial pressure during this waiting period so you’re not pushed into premature settlement.

With over 20 years of combined industry experience and NMLS certification, Best Call Funding provides transparent, compliant support to injured plaintiffs nationwide—helping you focus on recovery without financial strain.

Get Support Without Pressure

If you need financial assistance now,

apply online or call (844) 676-CASH (2274). Best Call Funding works with your attorney and provides updates within 24 business hours, allowing you to negotiate from strength, not desperation.

Frequently Asked Questions

How much of my expected settlement will Best Call Funding cover?

Most plaintiffs receive approximately 10% to 15% of their expected settlement value, depending on case strength, injury severity, and liability clarity. Your expected recovery influences the funding amount available to you.

What if my case takes longer than expected to settle?

Best Call Funding is designed for the long haul. Whether your case settles in 6 months or 18 months, your funding agreement remains in place and covers the entire waiting period.

Are there upfront costs or hidden fees?

No upfront costs, no hidden charges. Application and processing fees are included in your contract and deducted from your settlement if your case succeeds. You never pay anything out of pocket during the funding period—all costs come from settlement proceeds.

How quickly will I receive funding after approval?

Once approved, funding typically arrives within 24 to 48 hours. Wire transfers deliver funds the same day, direct deposit typically arrives within one business day, and paper checks are also available upon request. Most plaintiffs access their funds within 24 hours of approval.

Does my credit score affect my Best Call Funding eligibility?

No. Pre-settlement funding approval depends on case merit and supporting documentation—not personal financial history. Your case's strength, injury documentation, and attorney experience are the primary factors in approval decisions. Bankruptcy history can affect funding eligibility on a case-by-case basis.

How does Best Call Funding differ from personal loans or credit cards?

Best Call Funding requires no monthly payments during litigation, unlike traditional loans. Repayment occurs only after your case settles, and only from settlement proceeds. If your case doesn't succeed, you owe nothing—a true non-recourse arrangement that protects your financial security during the most vulnerable period of your recovery journey.